Indian Bank Specialist Officer Recruitment 2025

Application Period:

- Online Registration and Payment: September 23, 2025, to October 13, 2025 (both days inclusive).

Vacancies: Total: 171 vacancies across various posts in Scales II, III, and IV.

- Categories: SC, ST, OBC, EWS, UR, and PWBD (VI, HI, OC, ID).

- Reservation: Includes backlog vacancies for certain categories (marked with *).

- PWBD Reservation: Horizontal reservation; candidates must submit a disability certificate issued by a competent authority as per Government of India guidelines, dated on or before October 13, 2025.

Key Posts and Vacancies:

| Post Code | Post Name | Scale | Total Vacancies | SC | ST | OBC | EWS | UR | PWBD (VI/HI/OC/ID) |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Chief Manager – Information Technology | IV | 10 | 1 | 1 | 3 | 1 | 4 | 0/0/0/0 |

| 2 | Senior Manager – Information Technology | III | 25 | 4 | 2 | 6 | 2 | 11 | 0/1/0/0 |

| 3 | Manager – Information Technology | II | 20 | 3 | 4* | 4 | 2 | 7 | 0/1/0/0 |

| 4 | Chief Manager – Information Security | IV | 5 | 1 | 0 | 1 | 1 | 2 | 0/0/0/0 |

| 5 | Senior Manager – Information Security | III | 15 | 2 | 1 | 4 | 2 | 6 | 0/0/1/0 |

| 6 | Manager – Information Security | II | 15 | 2 | 3* | 3 | 1 | 6 | 0/0/1/0 |

| 7 | Chief Manager – Corporate Credit Analyst | IV | 15 | 2 | 2 | 4 | 2 | 5 | 0/0/1/0 |

| 8 | Senior Manager – Corporate Credit Analyst | III | 15 | 2 | 1 | 4 | 2 | 6 | 0/0/0/0 |

| 9 | Manager – Corporate Credit Analyst | II | 10 | 1 | 1* | 3 | 1 | 4 | 0/0/0/0 |

| 10 | Chief Manager – Financial Analyst | IV | 5 | 1 | 0 | 2 | 0 | 2 | 0/0/0/0 |

| 11 | Senior Manager – Financial Analyst | III | 3 | 1 | 0 | 0 | 0 | 2 | 0/0/0/0 |

| 12 | Manager – Financial Analyst | II | 4 | 1 | 1 | 1 | 0 | 1 | 0/0/0/0 |

| 13 | Chief Manager – Risk Management | IV | 4 | 1 | 0 | 1 | 0 | 2 | 0/0/0/0 |

| 14 | Chief Manager – IT Risk Management | IV | 1 | 0 | 0 | 0 | 0 | 1 | 0/0/0/0 |

| 15 | Senior Manager – Risk Management | III | 7 | 1 | 1 | 2 | 1 | 2 | 0/0/0/0 |

| 16 | Senior Manager – IT Risk Management | III | 1 | 0 | 0 | 0 | 0 | 1 | 0/0/0/0 |

| 17 | Senior Manager – Data Analyst | III | 2 | 0 | 0 | 1 | 0 | 1 | 0/0/0/0 |

| 18 | Manager – Risk Management | II | 7 | 1 | 1 | 2 | 1 | 2 | 0/0/0/0 |

| 19 | Manager – IT Risk Management | II | 1 | 0 | 0 | 0 | 0 | 1 | 0/0/0/0 |

| 20 | Manager – Data Analyst | II | 2 | 0 | 0 | 1 | 0 | 1 | 0/0/0/0 |

| 21 | Chief Manager – Company Secretary | IV | 1 | 0 | 0 | 0 | 0 | 1 | 0/0/0/0 |

| 22 | Senior Manager – Chartered Accountant | III | 2 | 0 | 0 | 1 | 0 | 1 | 0/0/0/0 |

| 23 | Manager – Chartered Accountant | II | 1 | 0 | 0 | 0 | 0 | 1 | 0/0/0/0 |

Note: Vacancies are provisional and may vary based on the bank’s requirements.

Application Restrictions:

- Candidates can apply for only one post. Multiple applications will result in only the latest valid application being retained, with fees for others forfeited.

- The bank may consider candidates for posts other than the one applied for, provided eligibility criteria are met.

Pay Scale and Emoluments

| Scale | Pay Scale (INR) | Additional Benefits |

|---|---|---|

| Scale II | 64,820 – 93,960 | DA, CCA, HRA/Leased accommodation, Leave Fare Concession, Medical Aid, Hospitalization Benefits, Retirement Benefits, and other perquisites as per bank rules. |

| Scale III | 85,920 – 105,280 | Same as above. |

| Scale IV | 102,300 – 120,940 | Same as above. |

Eligibility Criteria

Nationality/Citizenship:

- Citizen of India, or

- Subjects of Nepal, Bhutan, Tibetan refugees (pre-1962 settlers), or persons of Indian origin from specified countries with a certificate of eligibility from the Government of India.

Age, Educational Qualification, and Work Experience:

- Cut-off Date: September 1, 2025, for age, educational qualifications, certifications, and work experience.

- Qualifications must be from a recognized University/Institution/Board approved by the Government of India.

Detailed Eligibility by Post:

- Information Technology (Post Codes 1–3):

- Educational Qualification:

- 4-year Engineering/Technology Degree in Computer Science, IT, Electronics, or related fields, OR

- Postgraduate Degree in similar disciplines, OR

- Graduate with NIELIT ‘B’ Level certification.

- Certifications and Experience:

- Chief Manager (Scale IV): Age 28–36 years, mandatory certifications (e.g., ITIL Strategic Leader, CISSP, AWS Solutions Architect – Professional), 8 years’ IT experience with 5 years in a managerial/lead role in banking/finance.

- Senior Manager (Scale III): Age 25–33 years, mandatory certifications (e.g., Oracle Certified Professional, CCNP), 5 years’ IT experience with 2 years in a managerial/lead role.

- Manager (Scale II): Age 23–31 years, mandatory certifications (e.g., ITIL 4 Foundation, CCNA), 3 years’ IT experience.

- Educational Qualification:

- Information Security (Post Codes 4–6):

- Educational Qualification: BE/B.Tech or MCA/MSc in Computer Science, IT, or Cyber Security.

- Certifications and Experience:

- Chief Manager (Scale IV): Age 30–36 years, mandatory CISA/CISSP/CISM/CSSLP, 10 years’ experience in cyber security.

- Senior Manager (Scale III): Age 25–33 years, desirable certifications, 5 years’ experience.

- Manager (Scale II): Age 23–31 years, desirable certifications, 3 years’ experience.

- Corporate Credit Analyst (Post Codes 7–9):

- Educational Qualification: CA, or Graduation with 2-year MBA/MMS (Finance), PGDBA/PGDBM/CAIIB.

- Experience:

- Chief Manager (Scale IV): Age 28–36 years, 6–7 years’ experience in corporate credit.

- Senior Manager (Scale III): Age 26–33 years, 4–5 years’ experience.

- Manager (Scale II): Age 24–31 years, 2–3 years’ experience.

- Desirable Certifications: Credit Management, Commercial Credit, Certified Credit Professional, etc.

- Financial Analyst (Post Codes 10–12):

- Educational Qualification: CA, ICMA, or CFA.

- Experience:

- Chief Manager (Scale IV): Age 29–36 years, 6 years’ experience in corporate credit.

- Senior Manager (Scale III): Age 27–33 years, 4 years’ experience.

- Manager (Scale II): Age 25–31 years, 2 years’ experience.

- Risk Management & IT Risk Management (Post Codes 13–16, 18–19):

- Educational Qualification: CA, CFA, Master’s in Mathematics/Statistics/Finance/Economics, or Engineering with MBA/Diploma in Finance/Banking. For IT Risk: BE/B.Tech or MCA/MSc in Computer Science/IT/Data Science.

- Experience:

- Chief Manager (Scale IV): Age 28–36 years, 8 years’ experience with 3 years in risk management/IT compliance.

- Senior Manager (Scale III): Age 25–33 years, 5 years’ experience with 2 years in relevant fields.

- Manager (Scale II): Age 23–31 years, 3 years’ experience with 1 year in risk management/IT compliance.

- Desirable Certifications: FRM, PRM, CFA, CRISC, etc.

- Data Analyst (Post Codes 17, 20):

- Educational Qualification: CA, or Bachelor’s/Master’s in Computer Science/IT/MCA/Statistics/Mathematics/Economics.

- Experience:

- Senior Manager (Scale III): Age 25–33 years, 5 years’ experience in data analysis (preferably in BFSI).

- Manager (Scale II): Age 23–31 years, 3 years’ experience in data analysis.

- Desirable Certifications: SAS, Python, Data Science certifications.

- Company Secretary (Post Code 21):

- Educational Qualification: Member of ICSI; LLB/CA/ICMA desirable.

- Experience: Age 30–36 years, 5 years’ post-qualification experience, with 2 years in a listed entity.

- Chartered Accountant (Post Codes 22–23):

- Educational Qualification: Member of ICAI; ICMA/CFA/MBA (Finance) desirable.

- Experience:

- Senior Manager (Scale III): Age 27–33 years, 5 years’ experience in Accounts/Finance/Taxation/IndAS.

- Manager (Scale II): Age 23–31 years, 1 year’s experience in Accounts/Finance/Taxation/IndAS.

Age Relaxation:

- SC/ST: 5 years

- OBC (Non-Creamy Layer): 3 years

- PWBD: 10 years

- Ex-Servicemen: 5 years

- Persons affected by 1984 riots: 5 years

- OBC (Non-Creamy Layer) certificate must be issued on or after April 1, 2025, and valid until the interview date.

EWS Criteria:

- Gross annual family income < ₹8 lakh (for FY 2024–25).

- Exclusions: Ownership of 5+ acres agricultural land, residential flat ≥1000 sq.ft., or residential plots ≥100 sq. yards (notified municipalities) or ≥200 sq. yards (other areas).

- Valid Income & Asset Certificate required at the interview.

Job Roles (Key Responsibilities)

- Information Technology (Post Codes 1–3):

- Chief Manager: Formulate IT strategy, oversee infrastructure, cybersecurity, and compliance.

- Senior Manager: Lead IT projects, manage applications/networks, ensure compliance.

- Manager: Manage IT systems, provide L2/L3 support, assist in DR drills.

- Information Security (Post Codes 4–6):

- Develop security architectures, manage SOC, handle incident response, perform penetration testing, ensure compliance.

- Corporate Credit Analyst (Post Codes 7–9):

- Conduct due diligence, appraise credit proposals, ensure compliance with KYC and RBI guidelines, monitor industries.

- Financial Analyst (Post Codes 10–12):

- Analyze financial statements, assess risks, prepare reports for high-rated companies.

- Risk Management & IT Risk Management (Post Codes 13–16, 18–19):

- Manage liquidity, operational, market, and IT risks; develop policies, ensure compliance with Basel III and RBI guidelines.

- Data Analyst (Post Codes 17, 20):

- Analyze data sets, develop dashboards, contribute to risk management strategies.

- Company Secretary (Post Code 21):

- Ensure compliance with laws, manage investor relations, handle regulatory filings, and corporate actions.

- Chartered Accountant (Post Codes 22–23):

- Prepare financial statements, handle taxation, IndAS compliance, and file IT/GST returns.

Selection Procedure

- Mode of Selection:

- Shortlisting of applications followed by an interview, OR

- Written/Online Test followed by an interview.

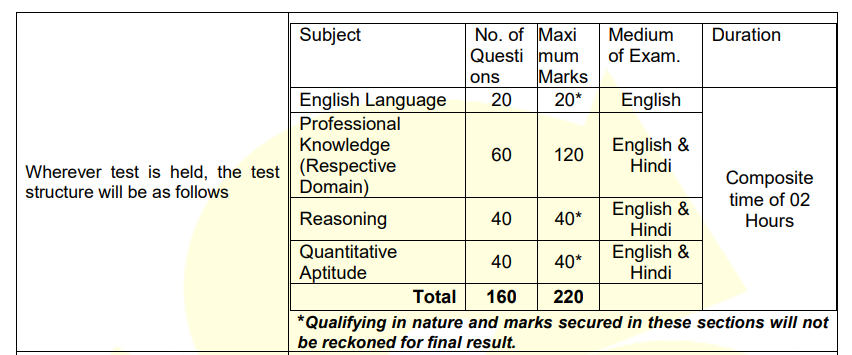

- Written/Online Test Structure: SubjectQuestionsMarksMediumDurationEnglish Language2020*EnglishComposite 2 hoursProfessional Knowledge (Domain)60120English & HindiReasoning4040*English & HindiQuantitative Aptitude4040*English & HindiTotal160220 *Qualifying in nature; marks not counted for final result.

- Penalty: 1/4th mark deducted for each wrong answer. No penalty for unanswered questions.

- Cut-off: Candidates shortlisted based on total marks (3x vacancies for UR, 5x for reserved categories).

- Interview:

- Total marks: 100.

- Minimum qualifying marks: 40% (UR/EWS), 35% (SC/ST/OBC/PWBD).

- Weightage: 80:20 (Test:Interview) if both are conducted; 100% interview if only shortlisting.

- Merit Order: In case of tied scores, candidates are ranked by date of birth (older candidates ranked higher).

Application Process

- Online Application: Apply via www.indianbank.bank.in (Careers page) from September 23 to October 13, 2025.

- Fees:

- SC/ST/PWBD: ₹175 (intimation charges).

- Others: ₹1,000 (inclusive of GST).

- Payment via Debit/Credit Card, Internet Banking, or UPI.

- Documents to Upload:

- Photograph (4.5cm x 3.5cm, 20–50 KB, JPG/JPEG).

- Signature (10–20 KB, JPG/JPEG, not in capital letters).

- Left thumb impression (20–50 KB, JPG/JPEG).

- Handwritten declaration (50–100 KB, JPG/JPEG, in English, not in capital letters).

- PWBD certificate (if applicable, PDF, <500 KB).

- Declaration Text: “I, _______ (Name of the candidate), hereby declare that all the information submitted by me in the application form is correct, true and valid. I will present the supporting documents as and when required.”

Important Notes:

- Candidates must ensure details (name, category, etc.) match certificates.

- No changes allowed post-submission.

- Incomplete applications or those with improper uploads will be rejected.

| NOTIFICATION | CLICK HERE |

| WHATSAPP GROUP JOB UPDATES | CLICK HERE |

Other Key Details

- Probation: 1 year for Scales II, III, and IV.

- Financial Cum Surety Bond: ₹3 lakh for minimum 2 years’ service; applicable if leaving before completion.

- Posting: Anywhere in India, transferable as per bank needs.

- Examination Centers: Across India (see Annexure I); interviews in Chennai or other centers (physical/online).

- PWBD Guidelines:

- Scribe facility for eligible candidates (certificate required as per Appendix I).

- Compensatory time: 20 minutes per hour for PWBD candidates (locomotor disability, VI, ID).

- Scribe must not be a candidate for this recruitment and should have a qualification one step below the candidate’s.

- Biometric/IRIS Verification: Conducted before/after the test/interview and at joining.

- Identity Verification: Valid photo ID (PAN, Passport, Aadhar, etc.) required at the test/interview.

General Instructions

- Candidates must produce original certificates at the interview.

- False information or misconduct (e.g., impersonation, unfair means) will lead to disqualification or termination.

- Bank reserves the right to modify/cancel the recruitment process.

- Disputes are subject to the jurisdiction of Chennai courts.

- Candidates must regularly check the bank’s website for updates.